Tesla is facing unprecedented turmoil in 2025 as ownership trends reveal a dramatic shift, driven by Elon Musk’s polarizing leadership and controversial political engagements. Once a beacon for eco-conscious and tech-savvy buyers, Tesla is hemorrhaging its loyal customer base, with ownership rates dropping and resale markets flooded with vehicles. Musk’s actions, from his role in the Trump administration’s Department of Government Efficiency (DOGE) to his far-right rhetoric, have sparked a massive fallout, threatening Tesla’s market dominance and brand legacy.

Recent data paints a grim picture. Tesla’s U.S. new vehicle registrations fell 17% in Q1 2025 compared to 2024, per Experian, while competitors like BYD and Rivian saw gains. Used Tesla listings on platforms like Carvana surged 30%, with Model 3 and Model Y units selling at 25% below their 2024 values. Owners cite Musk’s behavior as a key factor, with a J.D. Power survey revealing 62% of 2024 Tesla buyers would not repurchase due to “brand misalignment.” Social media is rife with owners trading in Teslas, often citing Musk’s DOGE involvement and his X posts alienating liberal-leaning EV enthusiasts.

Musk’s political pivot has fractured Tesla’s core demographic. His vocal support for Trump’s policies and leadership of DOGE, which aims to slash federal spending, have clashed with the values of Tesla’s environmentally focused buyers. A 2025 Pew Research poll found 58% of EV owners view Musk negatively, up from 34% in 2023. In Europe, Tesla sales dropped 45% in January 2025, with boycotts in Norway and Germany linked to Musk’s backing of far-right parties. Incidents like the arson of a French Tesla showroom in March underscore the growing backlash.

The fallout extends to Tesla’s financials. The company’s stock has tanked nearly 50% since December 2024, erasing $800 billion in market value. Musk’s net worth, tied to Tesla shares, has shrunk by $121 billion, per Forbes. Q1 2025 saw a 71% profit plunge to $409 million and a 13% drop in deliveries, the worst since 2022. Competition from BYD, which sold 4.2 million units in 2024, and affordable models from Hyundai and Kia have eroded Tesla’s 50% U.S. EV market share, now at 44%.

Musk’s divided focus compounds the crisis. His commitments to DOGE, SpaceX, and X have delayed Tesla’s promised affordable EV and robotaxi, now slated for mid-2025. Trump’s tariffs on China and Canada have disrupted supply chains, raising costs for Tesla’s Shanghai-built vehicles. In April, Musk vowed to scale back DOGE work, but analysts like Wedbush’s Dan Ives warn that brand damage may be “irreparable” without a leadership shakeup.

Tesla’s ownership trends signal a tipping point. Loyalists are abandoning ship, and new buyers are turning to competitors. Musk’s controversial reign has turned Tesla from a visionary trailblazer into a cautionary tale. Can he regain trust, or is Tesla’s downfall inevitable? The road ahead looks treacherous.

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

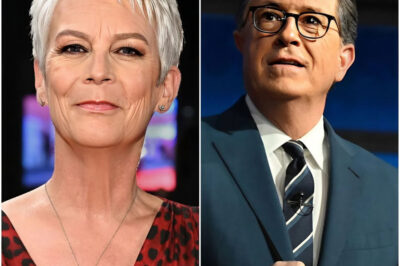

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

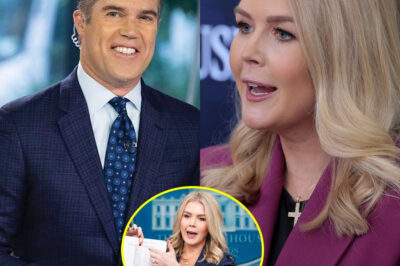

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load