Recent claims circulating on social media, including a post on X, allege that France has “shut down” Tesla and the U.S. auto industry, with Elon Musk reportedly losing $138.9 billion as Tesla’s valuation collapses. However, these claims appear exaggerated or unfounded based on available evidence, though Tesla is undeniably facing significant challenges in 2025. Let’s unpack the situation surrounding Musk, Tesla, and the broader context.

No credible reports confirm France banning Tesla or the U.S. auto industry. A related incident involved a Tesla showroom in France being torched in an arson attack in March 2025, destroying 12 vehicles worth £550,000, amid protests linked to Musk’s political ties and his support for right-wing European parties. This event, reported by the Daily Mail, reflects growing anti-Musk sentiment in Europe but does not equate to a nationwide shutdown. Tesla’s European sales have indeed slumped, with a 45% drop in January 2025, partly due to Musk’s controversial role in the Trump administration’s Department of Government Efficiency (DOGE).

Tesla’s financial woes are real. The company’s stock has plummeted nearly 50% since December 2024, wiping out over $800 billion in market capitalization. Musk’s net worth, heavily tied to Tesla shares, has reportedly fallen by $121 billion from a peak of $464 billion, per Forbes. While the $138.9 billion figure cited in the claim aligns closely with these losses, it overstates the immediate impact. Tesla’s Q1 2025 earnings revealed a 71% profit drop to $409 million and a 13% decline in vehicle deliveries, marking its worst quarter since 2022. Automotive revenue fell 20% to $13.9 billion, driven by global competition, particularly from China’s BYD, and a lack of new models.

Musk’s political involvement has exacerbated Tesla’s troubles. His leadership of DOGE and far-right rhetoric have alienated liberal EV buyers, Tesla’s core market. Protests, vandalism, and boycotts have surged, with incidents reported across the U.S., Canada, and Europe. In Canada, Tesla was removed from the Vancouver International Auto Show in March 2025 over safety concerns tied to Musk’s political actions. Meanwhile, Trump’s tariffs on Canada, China, and Mexico have disrupted Tesla’s supply chain, with CFO Vaibhav Taneja warning of significant profitability impacts.

Despite these setbacks, Musk remains the world’s richest person with a $325 billion net worth. Tesla’s stock volatility is not new; it faced similar declines in 2022 and 2024. Musk has pledged to refocus on Tesla by reducing DOGE work to one to two days per week, aiming to launch a new Model Y and robotaxi service in mid-2025. However, analysts remain skeptical, citing intense competition and brand erosion.

The claim of France “shutting down” Tesla is a distortion, but Tesla’s crisis is undeniable. Musk’s financial empire faces a pivotal moment, with his next moves critical to stabilizing the company. The collapse is severe, but not yet total—time will tell if Tesla can rebound.

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

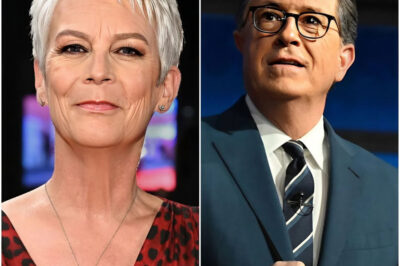

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

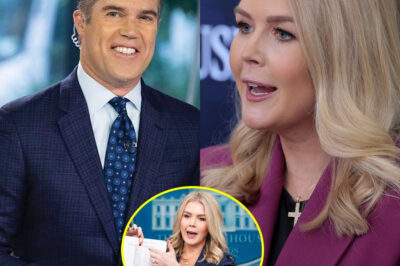

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load