In 2025, Elon Musk and Tesla are grappling with a perfect storm of crises that threaten to unravel the electric vehicle (EV) giant’s dominance. Tesla’s stock, once a darling of investors, has plummeted, erasing over $800 billion in market value since its December 2024 peak of $479.86 per share. A staggering 71% drop in first-quarter profits, coupled with a 13% decline in vehicle deliveries, signals a dire shift for the company. Musk’s polarizing political involvement and strategic missteps have alienated loyal fans, eroded market share, and left Tesla on the brink of a historic downfall.

The financial carnage is undeniable. Tesla’s stock has fallen 50% since mid-December, with shares closing at $222 in March 2025, marking its worst performance since 2020. Musk, still the world’s richest person, has seen his net worth shrink by $121.2 billion from a high of $464 billion, according to Forbes. This collapse stems from a 20% drop in automotive revenue and a first-ever annual sales decline, as reported in Tesla’s Q1 2025 earnings. Investors, once buoyed by Musk’s promises of autonomous driving and affordable models, are now rattled by unmet goals and a forward price-to-earnings ratio nine times higher than competitors like BYD.

Musk’s political antics have torched Tesla’s brand. His role in the Trump administration’s Department of Government Efficiency (DOGE) and far-right rhetoric have alienated eco-conscious, liberal customers—Tesla’s core demographic. A CNN poll found 53% of Americans view Musk negatively, while sales in EV-friendly markets like Norway and Germany plummeted 48% and nearly 60%, respectively. Protests at Tesla dealerships, vandalism, and bumper stickers reading “I bought this before Elon went crazy” reflect a growing backlash. Meanwhile, red-state consumers remain resistant to EVs, leaving Tesla without a clear customer base.

Competition is another dagger. China’s BYD surpassed Tesla as the top EV seller in 2024, boasting 4.2 million units sold compared to Tesla’s declining deliveries. BYD’s affordable models and hybrid offerings have captured markets where Tesla’s aging Model 3 and Y struggle. In Europe, overall EV sales rose 21% in January 2025, yet Tesla’s fell 50%, per Bank of America. The Cybertruck, hyped as a game-changer, sold only 38,965 units in 2024, far below Musk’s 250,000-unit goal.

Musk’s divided attention exacerbates the crisis. His focus on DOGE, X, and SpaceX has left Tesla rudderless, with no new models launched since the 2020 Model Y. Promises of a robotaxi and affordable EV by mid-2025 ring hollow amid trade wars and Trump’s tariff policies, which Musk admits could hurt Tesla. In April, Musk pledged to scale back DOGE work, but analysts warn the brand damage may be irreversible.

Tesla’s loyal fans are jumping ship, and its market share is crumbling. With competitors outpacing and investors fleeing, Musk faces an uphill battle to restore Tesla’s glory. The question looms: can he steer Tesla back, or is this the end of an era?

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

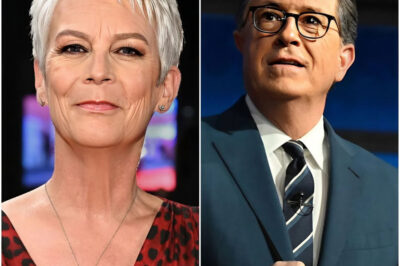

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

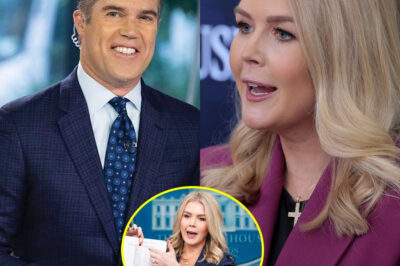

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load