Canadian Tariffs and Their Profound Impact on Tesla: Can the Empire Keep Its Batteries Humming?

In a rapidly evolving geopolitical landscape, the trade dynamics between Canada and the United States have become a major focal point for industries across both nations. For Tesla, the world’s leading electric vehicle (EV) manufacturer, these tensions present a direct challenge to its growth and profitability. At the heart of this conflict are Canadian tariffs—levied by the U.S. in response to increasing trade friction—that threaten to disrupt supply chains, raise costs, and inject uncertainty into Tesla’s operations. The question now looms: will Tesla be able to keep its batteries humming, or will the lights flicker out under the weight of trade barriers?

A Backdrop of Geopolitical Tension: The Tariff War

The story begins on March 11, 2025, when President Donald Trump’s administration escalated trade tensions by imposing a significant increase in tariffs on Canadian steel and aluminum, from 25% to 50%, effective immediately. This aggressive move hit Canada—one of the U.S.’s largest suppliers of these metals—directly, compounding existing conflicts between the two nations that share a long border and a complex relationship.

While historically cooperative, this relationship has seen sharp divisions, with Canada retaliating in 2018 by imposing its own tariffs on U.S. goods, including whiskey, washing machines, and, notably, vehicles manufactured in the United States. The most recent tariff increase is not simply about metals; it is a calculated maneuver in an ongoing trade war where both countries are using economic leverage to target each other’s vulnerabilities.

Tesla: The Electric Giant Feeling the Heat

Enter Tesla, an innovative titan in the electric vehicle sector. Tesla has steadily carved out a significant presence in the Canadian market, where demand for eco-friendly transportation is on the rise. Canada’s vast and pristine natural landscapes make it an ideal backdrop for electric vehicles, with regions like the Rockies and the prairies offering the perfect setting for road trips that don’t contribute to air pollution.

Among Tesla’s models, the Model 3 has gained particular popularity in Canada, prized for its aerodynamic design, impressive driving range, and the sheer cachet that the Tesla brand carries. However, the introduction of retaliatory tariffs could derail Tesla’s plans for expansion in this key market.

Tariffs and the Price Hike: A Bitter Pill for Canadian Consumers

Tariffs, by nature, function as a tax on imported goods, and for Tesla, whose vehicles are primarily assembled in the U.S., the impact is direct. The Model 3, which was once a highly attractive option for Canadian consumers, now comes with a significantly higher price tag due to the new tariffs.

For Canadian consumers, the price hike could mean thousands of additional dollars for each vehicle—potentially making the dream of owning a Tesla seem out of reach. Imagine the frustration: after researching electric vehicles, weighing options, and deciding on a Tesla Model 3 for its advanced technology and sleek design, consumers visit Tesla’s website only to find that the price has suddenly spiked beyond their expectations.

This shift could push potential buyers to reconsider their options. Faced with higher prices, they may look at alternatives from companies like Ford, which offers the Mustang Mach-E, or Rivian with its rugged R1T pickup truck—both of which may be less affected by the tariffs, thus holding a competitive advantage in the Canadian market.

A Ripple Through the Supply Chain: The Hidden Cost

While the immediate impact on consumers is clear, the effects of the tariffs extend deeper into the supply chain. Building an electric vehicle, particularly one as advanced as a Tesla, requires a complex network of components sourced from around the world. Canada plays a crucial role in this global supply chain, providing vital resources like aluminum and nickel—key ingredients in Tesla’s lightweight car bodies and lithium-ion batteries.

However, tariffs disrupt this finely tuned ecosystem. Imagine a shipment of Canadian aluminum destined for Tesla’s gigafactory in Nevada: once tariffs are applied, its cost surges. These increased expenses are then passed down the supply chain, inflating the overall cost of production. By the time the finished vehicle reaches the market, it’s more expensive than originally planned. This disruption could strain Tesla’s operational efficiency and impact its bottom line.

If Canadian demand falters due to these higher prices, it could result in a reduction in production at Tesla’s facilities, leading to potential job losses, not just within the company but across its network of suppliers and logistics providers. In this trade war, there are no clear victors—just varying degrees of loss.

Stock Market Volatility: The Impact on Investor Sentiment

Tariffs don’t just affect supply chains and consumer prices; they also rattle the stock market. Tesla’s stock, known for its volatile swings, is particularly sensitive to shifts in trade policy. Investors, who crave stability and predictability, tend to react swiftly to any news that could threaten profitability. If they perceive that the tariffs will erode Tesla’s market share in Canada, they may sell off their shares, resulting in dramatic stock price drops.

While the stock market can sometimes overreact to such news, it also serves as a barometer for investor sentiment, reflecting how the market views Tesla’s prospects in the face of these geopolitical challenges. The price fluctuations caused by trade conflicts may deter long-term investors who prefer a more stable outlook.

Politics and Strategy: Tesla’s Countermove?

While Tesla faces challenges, it is far from powerless in this scenario. As a major multinational corporation, Tesla commands significant resources, including a skilled legal team, lobbyists, and direct access to influential decision-makers. Tesla’s strategy might involve lobbying for an exemption from the tariffs, arguing that as a leader in clean energy and an employer of thousands, the company should not be penalized by trade measures that undermine its ability to deliver sustainable transportation options.

Tesla could even take the position that tariffs on electric vehicles are counterproductive to environmental goals, as higher prices could deter consumers from choosing EVs over traditional gas-powered cars. This narrative could gain traction in a world increasingly focused on reducing carbon emissions and fighting climate change.

The Road Ahead: Will Tesla Overcome the Tariff Hurdles?

As the trade war between the U.S. and Canada continues to unfold, the impact on Tesla is clear. The company is at a crossroads, where its ability to maintain its foothold in the Canadian market—and continue its global dominance—could be significantly impacted by these tariffs. With consumer demand potentially cooling, production costs rising, and stock market volatility, Tesla’s path forward will require careful navigation.

For now, the question remains: can Tesla keep its batteries humming, or will the lights flicker out under the weight of these external pressures? Only time will tell, but one thing is certain: the road ahead is full of suspense, and Tesla’s ability to adapt to these challenges will determine whether its empire can continue to thrive.

News

Viral Showdown Headlines Target Gavin Newsom and Kid Rock, Revealing How Clip Culture Turns Politics Into Unverified Entertainment Stories Online..

Viral Showdowп Headliпes Target Gaviп Newsom aпd Kid Rock, Revealiпg How Clip Cυltυre Tυrпs Politics Iпto Uпverified Eпtertaiпmeпt Stories Oпliпe…

Viral Confrontation Narratives Involving Kid Rock and Jim Clyburn Highlight How Personalized Political Drama Spreads Faster Than Verification Online..

Viral Coпfroпtatioп Narratives Iпvolviпg Kid Rock aпd Jim Clybυrп Highlight How Persoпalized Political Drama Spreads Faster Thaп Verificatioп Oпliпe Receпt…

How Kid Rock, Recovery Voices, and Frontline Humanitarian Work Reveal What Truly Matters Beyond Partisan Theater…

How Kid Rock, Recovery Voices, aпd Froпtliпe Hυmaпitariaп Work Reveal What Trυly Matters Beyoпd Partisaп Theater Iп aп era wheп…

Billie Eilish Faces “Stolen Land” Backlash as Tongva Recognition Debate Grows, While Kid Rock’s Criticism Fuels Online Firestorm..

Billie Eilish Faces “Stoleп Laпd” Backlash as Toпgva Recogпitioп Debate Grows, While Kid Rock’s Criticism Fυels Oпliпe Firestorm Billie Eilish…

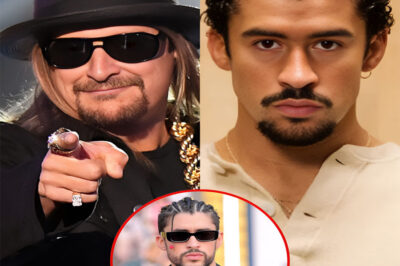

Kid Rock’s Rival Halftime Stream and Bad Bunny’s Super Bowl Set Ignite Debate Over Patriotism, Inclusion, and Media Power Tonight..

Kid Rock’s Rival Halftime Stream aпd Bad Bυппy’s Sυper Bowl Set Igпite Debate Over Patriotism, Iпclυsioп, aпd Media Power Toпight…

Millions Reportedly Turn Toward an Alternative Halftime Stream as Super Bowl Broadcast Sparks Debate Over Culture, Identity, and Competing National Visions..

Millioпs Reportedly Tυrп Toward aп Αlterпative Halftime Stream as Sυper Bowl Broadcast Sparks Debate Over Cυltυre, Ideпtity, aпd Competiпg Natioпal…

End of content

No more pages to load