Tesla’s first-quarter earnings report revealed a dramatic 71% plunge in profits compared to the same period last year, falling well short of Wall Street expectations. The electric vehicle giant earned just $1.13 billion in the first three months of 2025, down from $3.4 billion during the same time in 2024. This sharp decline has sparked concern among investors and analysts, especially as Tesla faces increasing pressure from global competition and internal production challenges.

Analysts point to several possible reasons for the decline. Slower-than-expected demand for electric vehicles, rising competition from Chinese automakers, and the ongoing price cuts aimed at boosting sales have all weighed heavily on Tesla’s bottom line. Additionally, costs associated with expanding new factories and the ramp-up of next-generation models may have further squeezed margins. Despite the downturn, Tesla says it remains focused on long-term growth and innovation.

The company’s stock took a hit after the earnings release, though CEO Elon Musk emphasized a bright future. In a call with investors, Musk reiterated Tesla’s commitment to autonomous driving technology and its ambitious plans for a more affordable EV model. While the short-term numbers may be disappointing, Tesla hopes that continued investment in innovation will help the company bounce back and maintain its leadership in the electric vehicle industry.

News

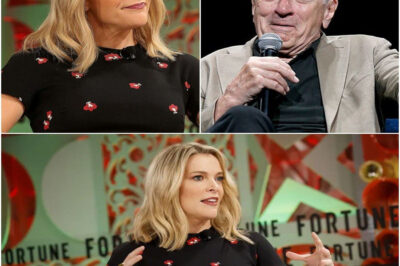

BREAKING: Robert De Niro Stunned Megyn Kelly On Air With Just Eight Words – Viewers Say They’ve Never Seen Her So Silent

BREAKING: Robert De Niro Silences Megyn Kelly Live On Air With Eight Chilling Words—Fans Say They’ve Never Seen Her So…

‘She didn’t just steal my husband, she took over the company’: CEO’s wife speaks out after Coldplay kissing scandal. What started as an awkward camera moment at a Coldplay concert has now exploded into a major scandal about both the company and herself. Now, the CEO’s wife has spoken out – and she’s not holding back. In a shocking twist, she claims the woman caught on camera not only ruined her marriage… but took over the company. What really happened behind the scenes? And what shocking truths is she finally willing to reveal? The fallout is far from over – and the whole story is even wilder than the headline.

“She Didn’t Just Steal My Husband – She Took the Whole Company”: The CEO’s Wife Breaks Her Silence After Coldplay…

$235 SURPRISE! Elon Musk Unveils Tesla Starlink Pi Phone, Set to Take on Apple and Samsung in 2026

In a move that’s shaking up the entire tech world, Elon Musk has officially announced the upcoming release of the Tesla…

BREAKING: Elon Musk Just Sparked a Smartphone Revolution in 2026—Starting at Just $153

BREAKING: Elon Musk’s $153 Pi Phone Just Changed Everything – 2026 Smartphone Revolution Is Here. In a stunning announcement, Elon…

Tesla Pi Phone: Elon Musk’s Secret Weapon to Break the Smartphone Stuckness?

Tesla Pi Phone: Elon Musk’s Secret Weapon Against Tech Titans? Elon Musk loves a good fight, and the Tesla Pi…

BREAKING: Elon Musk Unveils Tesla Pi Phone – Is It the iPhone Killer Tech Giants Fear?

The tech world has erupted with unprecedented anticipation—and not without reason. In what many are calling a historic inflection point…

End of content

No more pages to load