Europe is making a seismic shift in its economic relationship with the United States, marking a pivotal moment in global finance. As President Donald Trump’s tariffs on European goods take their toll, EU leaders are quietly but decisively cutting back their holdings of U.S. Treasury bonds, signaling a potential reconfiguration of the transatlantic partnership that has defined international trade for decades.

Reports from the European Commission reveal a growing urgency among leaders to confront the reality of rising costs and strained alliances. The tariffs, initially framed as a trade strategy, have morphed into a broader struggle for economic power, prompting Europe to reconsider its role in a system increasingly shaped by American interests. With a projected loss exceeding 150 billion euros for European businesses in the next two years due to these tariffs, the stakes are high.

The implications of this shift are profound. For the first time, European policymakers are openly discussing strategies to reduce their reliance on the U.S. dollar, a currency long considered a pillar of global finance. Insiders at the European Central Bank have noted a deliberate trimming of U.S. debt holdings, a move that analysts suggest is not merely technical but a significant political statement against American protectionism.

Moreover, the euro’s share in global financial transactions is on the rise, reflecting a growing preference for euro-based settlements over dollar-denominated contracts. This trend is particularly alarming for Washington, as it indicates a potential erosion of the dollar’s dominance as the world’s reserve currency. The shift is so pronounced that even historically aligned nations like Denmark and Sweden have suspended purchases of new U.S. Treasury issues, citing concerns over American political instability.

The urgency within Europe is palpable, with discussions of creating a continent-wide energy market insulated from dollar pricing and developing industrial support programs anchored entirely in euro financing. These initiatives underscore a collective determination to reshape the financial framework that governs global trade, moving away from a dependency on U.S. economic power.

As the United States grapples with its rising national debt, the ramifications of Europe’s actions could escalate dramatically. Analysts warn that if the EU continues to divest from U.S. debt, Treasury yields could soar, creating a financial crisis that would reverberate through the American economy. The sense of unease is growing in Washington, where advisers are contemplating potential retaliatory measures against European financial maneuvers.

This is not merely a trade dispute; it is a fundamental challenge to the established order of global finance. Europe’s quiet realignment represents a strategic pivot that could redefine the balance of power in international economics. As the world watches, the question remains: what happens when an ally chooses a new path? The answer may well determine the trajectory of global trade for generations to come.

News

“Sir, that boy lives in my house” — What he said next caused the millionaire to break down

Hernán had always been one of those men who seemed invincible. Business magazines called him “the king of investments,” conferences…

A MILLIONAIRE ENTERS A RESTAURANT… AND IS SHOCKED TO SEE HIS PREGNANT EX-WIFE WAITING

The day Isabela signed the divorce papers, she swore that Sebastián would never see her again. “I swear you’ll never…

Emily had been working as a teacher for five years, but she was unfairly dismissed…

Emily had been working as a teacher for five years, but she was unfairly fired. While looking for work, she…

A billionaire lost everything… until his poor daughter, a black maid, did the unthinkable… – bichnhu

A billionaire lost everything, until his poor son, a black maid, did the unthinkable. The computer screen lit up red…

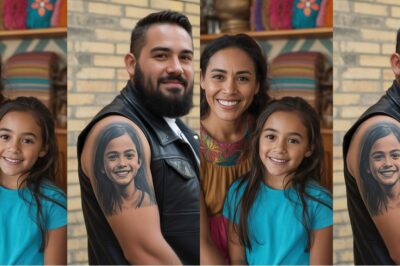

“Eight years after her daughter disappeared, a mother recognizes her face tattooed on a man’s arm. The truth behind the image left her breathless.”

One afternoon in early July, the boardwalk in Puerto Vallarta was packed. Laughter, the shouts of playing children, and the sound of…

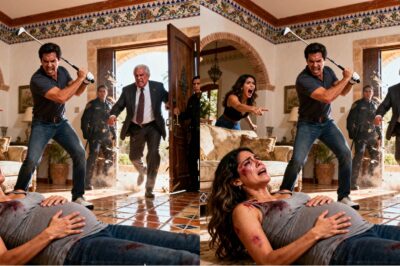

As my husband beat me with a golf club, I heard his mistress scream, “Kill him! He’s not your son!” I felt my world crumble… until the door burst open. My father, the ruthless CEO, roared, “Today you’ll pay for what you did.” And in that moment, I knew… the real storm was just beginning.

As my husband, Andrew , beat me with a golf club in the middle of the living room, I could barely protect…

End of content

No more pages to load