In a shocking turn of events, China’s recent agricultural policies have led to the rapid decimation of the U.S. soybean market, wiping out an astonishing $14 billion in just 72 hours. This unprecedented move raises grave concerns not only for American farmers but also for the broader implications for the U.S. dollar. As tensions rise between the two economic giants, the fallout from this soybean slaughter could have far-reaching consequences.

The Immediate Impact on the Soybean Market

The soybean market, long a staple of American agriculture, has faced turbulent times in recent years. However, few could have anticipated the scale of destruction unleashed by China’s sudden imposition of tariffs and import restrictions. Within a mere three days, contracts worth billions collapsed, leaving farmers and investors scrambling to reassess their strategies.

The Chinese government has justified these measures as a response to ongoing trade disputes and allegations of unfair agricultural practices. As the world’s largest importer of soybeans, China’s actions sent shockwaves through the market, causing prices to plummet and leaving U.S. farmers facing severe losses.

Economic Ripple Effects

The ramifications of this soybean slaughter extend beyond agriculture. With soybeans being a significant export commodity, the fallout threatens the livelihoods of countless farmers and the economic stability of rural communities. The U.S. Department of Agriculture (USDA) estimates that the losses could lead to a ripple effect, impacting related industries such as transportation, processing, and retail.

Moreover, as farmers grapple with financial instability, the potential for increased loan defaults could further strain the agricultural sector. This turmoil raises questions about the resilience of the U.S. economy as it faces mounting pressure from international trade challenges.

Is the Dollar Next?

The swift decline in the soybean market has sparked fears that the U.S. dollar may be next in the crosshairs of international trade tensions. Historically, commodities like soybeans have played a vital role in supporting the dollar’s strength on the global stage. As confidence in U.S. agricultural exports wanes, so too could confidence in the dollar.

Analysts are closely monitoring the situation, warning that a continued decline in commodity exports may lead to a depreciation of the dollar. A weaker dollar could have widespread implications, including increased inflation and higher import costs for American consumers.

The Path Forward

As the dust settles from this soybean slaughter, American farmers and policymakers must reconsider their strategies. Diversification of crops and exploration of new markets may become essential for stability. Furthermore, fostering stronger relationships with other trading partners could mitigate the risks posed by reliance on a single market.

Additionally, the U.S. government may need to reassess its trade policies and engage in diplomatic efforts to resolve tensions with China. A collaborative approach could pave the way for more stable trade relations and restore confidence in U.S. agricultural exports.

Conclusion

China’s swift and devastating actions against the U.S. soybean market serve as a stark reminder of the fragility of global trade relationships. With $14 billion lost in just 72 hours, the implications extend far beyond agriculture, raising concerns about the future of the U.S. dollar and the economy at large. As American farmers face unprecedented challenges, the path forward will require innovation, resilience, and strategic diplomacy to navigate this complex landscape. The stakes have never been higher, and the world will be watching closely to see how the U.S. responds.

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

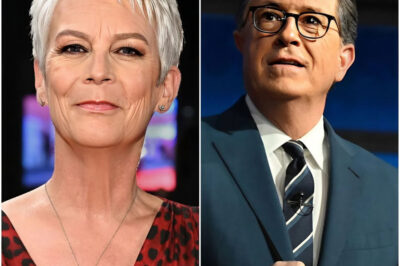

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

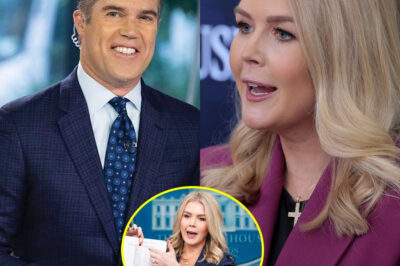

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load