Tesla’s first-quarter earnings report for 2025 has sent shockwaves through the tech and automotive worlds, with profits plummeting 71% to $2.3 billion and revenue dropping 9% to $19.3 billion compared to the previous year. The electric vehicle giant’s automotive revenue fell 20%, with global deliveries slumping 13% to 336,681 vehicles, marking Tesla’s worst quarter since 2022. This catastrophic decline, coupled with a 50% stock drop from its mid-December peak, has been widely attributed to a global backlash against CEO Elon Musk’s controversial political role in the Trump administration’s Department of Government Efficiency (DOGE). Facing mounting pressure, Musk announced he will scale back his DOGE involvement to one or two days a week starting May 2025, refocusing on steering Tesla out of its deepening crisis.

Musk’s high-profile position at DOGE, where he pushed for federal spending cuts, triggered widespread protests and vandalism targeting Tesla dealerships and vehicles worldwide. Sales tanked in key markets like Europe, with a 76% decline in Germany, as Musk’s endorsement of far-right parties alienated environmentally conscious EV buyers. Posts on X reflect the public’s fury, with users like @TheDemCoalition claiming Musk’s actions have tarnished Tesla’s brand. Meanwhile, competition from Chinese rival BYD, which saw a 75% sales surge in Europe, has eroded Tesla’s market dominance, with BYD overtaking Tesla as the world’s top EV seller in recent quarters.

During Tesla’s earnings call, Musk dismissed brand damage claims, attributing the sales drop to economic uncertainty and tariffs imposed by the Trump administration. He argued Tesla’s localized supply chains make it less vulnerable to tariffs but acknowledged their impact on low-margin businesses. Yet, analysts like Dan Ives of Wedbush Securities warn that Musk’s “brand tornado” has cost Tesla 10% of its global customer base, with boycott calls growing louder. Investors, initially buoyed by Musk’s Trump ties post-election, have soured, with Tesla’s valuation shedding $700 billion since December.

Musk remains defiant, touting Tesla’s future with promises of affordable models by June 2025 and a driverless robotaxi service by year-end. However, skepticism abounds, as Tesla has a history of missing Musk’s ambitious timelines, particularly for autonomous driving. The company’s aging EV lineup and the underwhelming Cybertruck launch have further dented its appeal.

What’s next for Musk? His partial retreat from DOGE signals a desperate bid to salvage Tesla, but the damage may be deep. With shareholders like Ross Gerber demanding he choose between politics and Tesla, Musk faces a pivotal moment. The tech billionaire’s empire is faltering, and his next moves—whether doubling down on innovation or navigating the political fallout—will shape his legacy and Tesla’s survival in an increasingly competitive EV landscape.

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

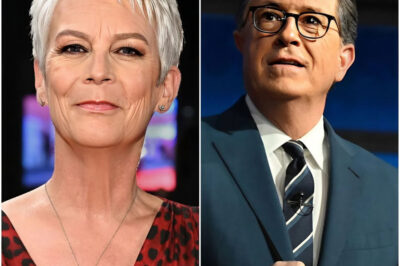

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

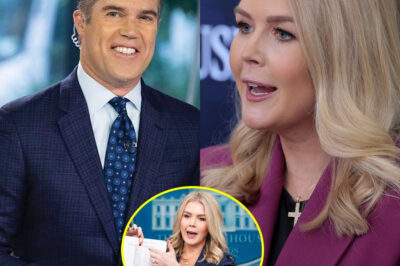

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load