Elon Musk’s vision for Tesla’s future fleet has been dealt a devastating blow as President Trump’s escalating trade war with China imposes a crippling 245% tariff on imported components, skyrocketing prices for Tesla’s upcoming Cybercab and Tesla Semi. The Cybercab, a self-driving robotaxi unveiled in October 2024 with a promised price tag of under $30,000, now faces a staggering cost of $200,000 due to the tariffs, according to industry analysts. Similarly, the Tesla Semi, an electric truck set for mass production in 2026, has seen its estimated price balloon to $1 million per unit, a far cry from earlier projections. This unprecedented price surge, reported on April 17, 2025, threatens to derail Tesla’s ambitious plans to dominate the autonomous vehicle and heavy-duty EV markets.

The tariffs, which began at 34% and rose to 145% by early April, have now reached a staggering 245%, severely impacting Tesla’s supply chain. Tesla had planned to source critical components for the Cybercab and Semi from China, with trial production slated for October 2025 and mass production in 2026. However, the company suspended these orders as the tariffs made costs unmanageable, despite earlier efforts to absorb the financial hit. Musk, a vocal advocate for free trade, has publicly criticized the tariffs, even appealing directly to Trump to reverse them, but to no avail. The fallout has already forced Tesla to halt deliveries of Model S and Model X in China, which retaliated with a 125% tariff on U.S. goods, further straining the company’s global operations.

The Cybercab, envisioned as the cornerstone of Tesla’s robotaxi service launching in Austin in June 2025, was meant to revolutionize affordable autonomous transport. Musk had boasted it would cost just 20 cents per mile to operate, compared to a dollar for a bus ride, but at $200,000, its affordability is shattered, alienating potential fleet operators. The Tesla Semi, crucial for Tesla’s push into sustainable logistics, now faces a price point that could deter major buyers like PepsiCo, which has relied on early Semi deliveries. With Tesla already reeling from a 71% profit drop in Q1 2025 and a 50% stock decline since December 2024, these price hikes could cripple its EV dreams.

Musk’s decision to refocus on Tesla, abandoning his role in the Department of Government Efficiency (DOGE) and government projects, may have come too late. The tariffs, intended to boost U.S. manufacturing, have ironically harmed Tesla, which relies heavily on global supply chains despite its U.S.-based assembly. As Chinese rival BYD surges ahead, capturing the top EV spot with a 75% sales increase in Europe, Tesla’s future looks bleak. Can Musk navigate this crisis with his promised affordable models and robotaxi service, or will these tariffs mark the beginning of the end for Tesla’s dominance in the EV market? The stakes have never been higher for the billionaire and his embattled company.

News

LIVE TV: Tyrus Causes Unprecedented Chaos on The View

LIVE TV EXPLOSION — Tyrus storms onto The View set and makes a shocking accusation: “You brought me here to…

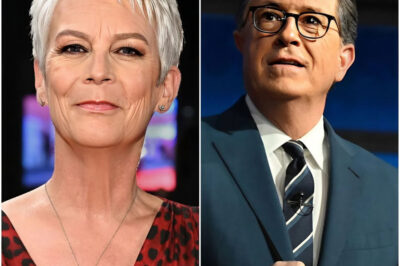

Jamie Lee Curtis Slams CBS Amid Colbert Scandal — Colbert, Maddow Romance Rumors Rock the Entertainment Industry

Jamie Lee Curtis is calling out CBS, accusing the network of trying to silence her in the wake of the…

MSNBC in Turmoil: Beloved Hosts Leave, Ratings Plunge — Is the Network on the Brink?

MSNBC’s Turmoil: As Beloved Hosts Exit and Viewership Plummets, What Desperate Measures Is the Network Taking? Uncover the Startling Realities…

EVENTUAL FALLOUT: The View Faces $50 Million Fine After Carrie Underwood’s Fierce On-Air Attack

Shocking aftermath: The View host is facing a whopping $50 million fine and even the threat of being banned from…

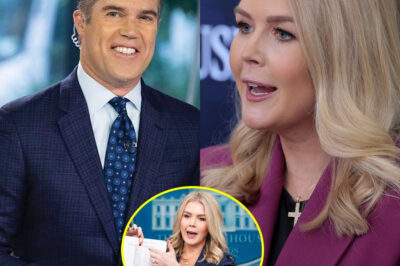

SHOCKING DEVELOPMENT: NBC’s Peter Alexander Stunned After Fierce On-Air Clash With Karoline Leavitt

Fox News’ Karoline Leavitt Stuns Reporters with Fiery Exchange During White House Briefing: A Turning Point in Political Discourse In…

SHOCKING LIVE TV MOMENT: Karoline Leavitt storms Colbert’s stage, leaving audience and crew stunned

The Ed Sullivan Theater crackled with electricity on the night that political commentator Karoline Leavitt faced off with late-night host…

End of content

No more pages to load