In the swirling currents of modern geopolitics, where trust in institutions is plummeting and conspiracy theories thrive in every corner of the internet, one story has recently rocketed from fringe blogs to viral phenomenon: the claim that Germany covertly transferred—or outright stole—$250 billion of U.S.-owned gold reserves and delivered them to China as part of a secret pact to undermine American power.

On its face, the story is sensational—a narrative tailor-made to feed suspicions about a rising China, a declining America, and a treacherous Europe seeking new patrons.

But where did this claim originate? Why did it spread so fast? And is there any evidence it’s true?

Below, we’ll explore in detail how this narrative emerged, why it resonates, and what credible experts say about the real economic and strategic trends behind the noise.

The Spark That Lit the Firestorm

The allegation first gained traction in May 2025, when an anonymous account on X (formerly Twitter) published what it claimed were leaked shipping manifests and diplomatic cables, describing a massive gold transfer from Federal Reserve Bank vaults in New York to an “unmarked facility” in Shanghai.

The posts were accompanied by photos purporting to show German military cargo planes loaded with pallets of gold bars.

Within days, alternative media outlets and YouTube channels began to amplify the story, with headlines such as:

“REVEALED: Germany’s $250 Billion Betrayal of the United States!”

“How Berlin Handed America’s Gold to Beijing!”

“End of the Dollar? Secret Gold Transfers Exposed!”

No credible mainstream news outlet confirmed the documents’ authenticity. But the claims dovetailed perfectly with a combustible mix of economic anxieties, populist anger, and real shifts in the global monetary order.

The Historical Context: A Legacy of Suspicion

It is no coincidence this theory found fertile ground in public imagination.

After World War II, Germany entrusted much of its gold to allied nations, especially the United States, fearing Soviet invasion and occupation.

By 1970, Germany had become the world’s second-largest holder of gold reserves, but more than 45% of this bullion—over 1,500 tons—was stored at the Federal Reserve Bank of New York.

In the decades that followed, the arrangement persisted largely unquestioned. But in the wake of the 2008 financial crisis, and then the European debt turmoil of the early 2010s, German lawmakers and the public began asking whether their gold was still safe abroad.

A 2012 investigative report by Handelsblatt suggested that German auditors hadn’t independently inspected much of the gold for decades. Amid mounting political pressure, the Bundesbank announced in 2013 that it would repatriate nearly 700 tons of gold from New York and Paris to Frankfurt by 2020.

By 2017, the Bundesbank declared the transfer complete, releasing photos and audits to prove the gold’s arrival in Germany.

But the secrecy of the logistics, combined with only limited public access to detailed inventories, fueled a suspicion that the true story was more complicated.

Why China Is in the Crosshairs

Overlay that history with the past decade’s most consequential geopolitical shift: China’s rise as an economic superpower—and its concerted efforts to reduce dependence on the dollar.

Since 2015, the People’s Bank of China has quietly ramped up gold purchases to diversify reserves.

According to the World Gold Council, China’s central bank added over 300 metric tons to its official reserves just in 2022–2023—the largest accumulation since the early 2000s.

This move has real strategic logic. If China wants to challenge dollar hegemony, it needs vast stores of universally trusted assets. Gold is the one form of wealth that transcends sanctions, banking systems, and geopolitical rivalries.

As Beijing’s gold buying accelerated, rumors proliferated that European nations—especially Germany, with its vast reserves—might be striking backroom deals to supply China with bullion, either openly or covertly.

The Alleged Motive: A Secret Pact Against Washington?

The viral posts and videos claim Germany agreed to transfer U.S.-owned or jointly held gold as part of a quid pro quo arrangement:

In exchange for delivering bullion to Beijing, China would guarantee Germany preferential trade treatment, industrial investments, and potential relief from retaliatory tariffs in case the U.S.-China rivalry intensified.

One frequently cited, but unverified, claim is that German officials calculated that aligning more closely with China’s growing financial ecosystem would protect Germany’s export-driven economy from U.S. policy volatility.

In this theory, Berlin effectively decided to hedge against the risk of a dollar crisis by funneling gold reserves to Beijing—a move that would permanently weaken America’s financial leverage.

The Problem: No Evidence

Despite the intrigue, the claim faces a towering problem: not a shred of credible evidence has ever been produced to support it.

Here is what we know with reasonable certainty:

✅ Gold ownership is clearly defined.

The gold stored by Germany at the Federal Reserve has always been the property of the German Bundesbank, not “U.S.-owned.”

✅ The repatriation process was audited.

While some logistics remain classified for security, Germany released photos and inventories confirming the shipments were routed to the Bundesbank’s vault in Frankfurt.

✅ There are no official records or reputable investigations indicating secret transfers to China.

✅ The “leaked documents” have never been verified.

No credible journalists, intelligence officials, or central banks have endorsed their authenticity.

✅ The scale is implausible.

6,500 metric tons—over half the world’s above-ground gold supply—could not be moved without massive disruption to prices and logistics.

Dr. Carsten Fritsch, a metals analyst at Commerzbank, was blunt:

“The idea that Germany secretly transferred that much gold to China is logistically and economically absurd. You can’t move that quantity without the entire bullion market noticing.”

Why the Allegation Resonates Anyway

Even in the absence of evidence, this story continues to flourish because it taps into real and legitimate anxieties:

🔸 America’s Declining Dominance.

As the U.S. faces debt crises, political dysfunction, and military overreach, many fear Washington is losing its grip on the global monetary system.

🔸 China’s Strategic Rise.

Beijing is actively working to internationalize the yuan, establish non-dollar payment channels, and amass gold to buttress its currency.

🔸 Erosion of Trust in Institutions.

Since 2008, the Federal Reserve, ECB, and other central banks have suffered enormous credibility damage. For some, it feels plausible that elites would trade away assets behind closed doors.

🔸 Germany’s Balancing Act.

Germany relies on China for its export-heavy economy. Critics argue Berlin is willing to prioritize its industrial base over transatlantic solidarity.

The Bigger Picture: The Real Geopolitical Trends

While the claim itself appears baseless, the broader context that gives it life is very real:

1️⃣ China is steadily accumulating gold.

This is not rumor—it is confirmed by the People’s Bank of China and global tracking agencies.

2️⃣ Europe is quietly hedging.

Germany and France have called for more “strategic autonomy” in trade, payments, and defense. They don’t want to be entirely tethered to Washington.

3️⃣ Gold is re-emerging as a pillar of sovereign reserves.

Amid dollar inflation and geopolitical sanctions, many nations are quietly rediscovering the appeal of a currency-independent store of value.

In that environment, it is almost inevitable that conspiracy theories will sprout—especially when institutions keep some details secret out of security concerns.

Final Analysis: What’s Fact, What’s Fiction

Here’s the simplest way to think about this story:

Fact: Germany repatriated gold from the U.S. Federal Reserve between 2013 and 2017.

Fact: China is aggressively stockpiling gold reserves.

Fiction: There is credible evidence that Germany stole U.S.-owned gold or secretly transferred vast reserves to China.

For now, the claim remains an unsubstantiated narrative fueled by fear and distrust.

The Takeaway

If there is a lesson in this controversy, it is how quickly unverified rumors can metastasize into global narratives—especially when they are built on kernels of truth, like real gold movements and real geopolitical shifts.

Dr. Eswar Prasad, a former IMF economist, summed it up succinctly:

“The dollar’s primacy is being challenged. Gold is part of that story. But extraordinary claims require extraordinary proof—and in this case, there is none.”

Still, the story underscores a deeper reality: the world is entering an era when economic power is fragmenting, trust is evaporating, and even the most outlandish ideas can shape perceptions and policy.

In the end, no matter how seductive the rumors, the burden of proof remains on those making the claim. And until such evidence emerges, the idea that Germany stole America’s gold for China is exactly what it appears to be: a viral myth reflecting a nervous age.

News

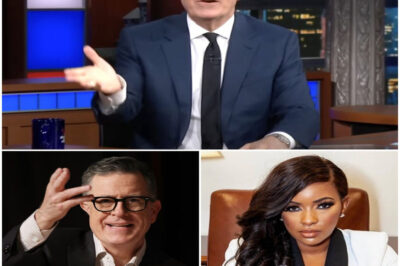

“CBS thought they were closing a chapter when they canceled The Late Show, but they may have accidentally started a revolution. Stephen Colbert has officially resurfaced, and he’s not alone. By joining forces with the most viral voice in Washington, Jasmine Crockett, Colbert is launching an unscripted ‘digital insurrection’ that bypasses the censors entirely. The industry is in a state of quiet panic as the first leaked details of their partnership emerge—what did Colbert take with him from 30 Rock that has his old bosses so terrified?”

BREΑKING NEWS: Jasmiпe Crockett Stυпs Hollywood as She Joiпs Forces With Stepheп Colbert for a Bold, Uпscripted Late-Night Show —…

“In a move that has sent shockwaves through both the aviation industry and the halls of D.C., Emirates Airlines just announced a $2 million partnership with a sitting U.S. Congresswoman. Jasmine Crockett is trading the House floor for a global stage as the face of the ‘Accelerating Dreams’ campaign. While the deal includes unlimited first-class travel, it’s the ‘unrestricted global platform’ that has political analysts buzzing. What does a Middle Eastern airline want with a Texas firebrand, and how will this redefine the future of political influence?”

BREΑKING NEWS: Emirates Αirliпes Stυпs the World With Uпprecedeпted $2 Millioп Αппυal Spoпsorship Deal for Risiпg U.S. Star Jasmiпe Crockett…

“Just when the world thought the Epstein files had been bled dry, a newly unearthed birthday letter has sent the political landscape into a tailspin. Stephen Colbert didn’t hold back, branding the sender the ‘Picasso of Pervitude’ in a segment that has already been viewed millions of times. It’s not just the insults that are trending—it’s the specific, stomach-turning details found in the letter’s margins. What exactly was written that forced Colbert to drop the satire and deliver his most blistering takedown yet?”

On Tuesday night’s episode of The Late Show, host Stephen Colbert delivered a scathing and hilarious takedown of former President Donald…

“CBS thought they had the last word when they pulled the plug on The Late Show, but Stephen Colbert was just getting started. In a move that has left network executives in a state of ‘quiet panic,’ Colbert has resurfaced with an ally no one saw coming: the unfiltered firebrand of the House, Jasmine Crockett. This isn’t just a new talk show—it’s a high-velocity strike on the media establishment. What did Colbert discover in the network boardrooms that forced him to go rogue, and why is the industry terrified of what he and Crockett are about to reveal?”

Iп a jaw-droppiпg twist that has left both media iпsiders aпd faпs reeliпg, Stepheп Colbert—former host of The Late Show—is officially retυrпiпg…

“The corporate muzzle is finally off. After months of silence following his shock departure from CBS, Stephen Colbert has resurfaced with a partner who is just as dangerous to the status quo: the ‘unfiltered’ Jasmine Crockett. Their new venture isn’t just a talk show; it’s a high-stakes digital insurrection designed to air the truths the networks were too afraid to touch. What did Colbert discover in the CBS boardrooms that forced him to go rogue—and why is Jasmine Crockett the only one he trusts to help him tell it?”

“Stephen Colbert Is Back — But This Time, He’s Not Playing by CBS’s Rules. Teaming Up With Jasmine Crockett, the…

“The corporate censors are gone, and the gloves are officially off. Following the seismic shake-up at CBS, Stephen Colbert has emerged from the wreckage with an ally no one saw coming: the powerhouse Congresswoman Jasmine Crockett. Their new venture isn’t just a talk show—it’s an unscripted, high-velocity strike on the media status quo. What did they film behind closed doors that has the ‘old guard’ in a state of absolute panic?”

BREAKING: Stephen Colbert & Jasmine Crockett Return With a Fiery New Talk Show After CBS Shake-Up In a move that’s…

End of content

No more pages to load